For your average person, investing begins and often ends with traditional retirement accounts, personal real estate, and maybe some stock market investments. What happens if your income and overall net worth start to exceed the norm. For a single earner bringing in more than $144,000 a year, your contribution limit for an IRA is zero dollars.

In those cases, you’re wandering close to the territory of an accredited investor. Accredited investors typically earn more than $200,000 a year or have a net worth of over $1 million. That’s the point where you look at private equity funds.

So, what are private equity funds and how do they work? Keep reading for our guide to this investment option.

What Is Private Equity?

Private equity refers to a particular type of financing where money is invested into private companies. The targets for investment are typically mature companies. In many cases, the companies are in trouble but show the potential to become profitable with changes in management and internal processes.

Private equity may serve as a direct investment or it may happen in the form of a leveraged buyout. A leveraged buyout uses a combination of money from a private equity company and money borrowed from a financial institution. The company doing the buyout secures a controlling interest in the company Private Equity Company Melbourne.

This controlling interest lets them make the necessary changes to turn the company around and make it profitable again. At that point, the investors may sell off the business to a third company or even take the company public.

What are Private Equity Funds?

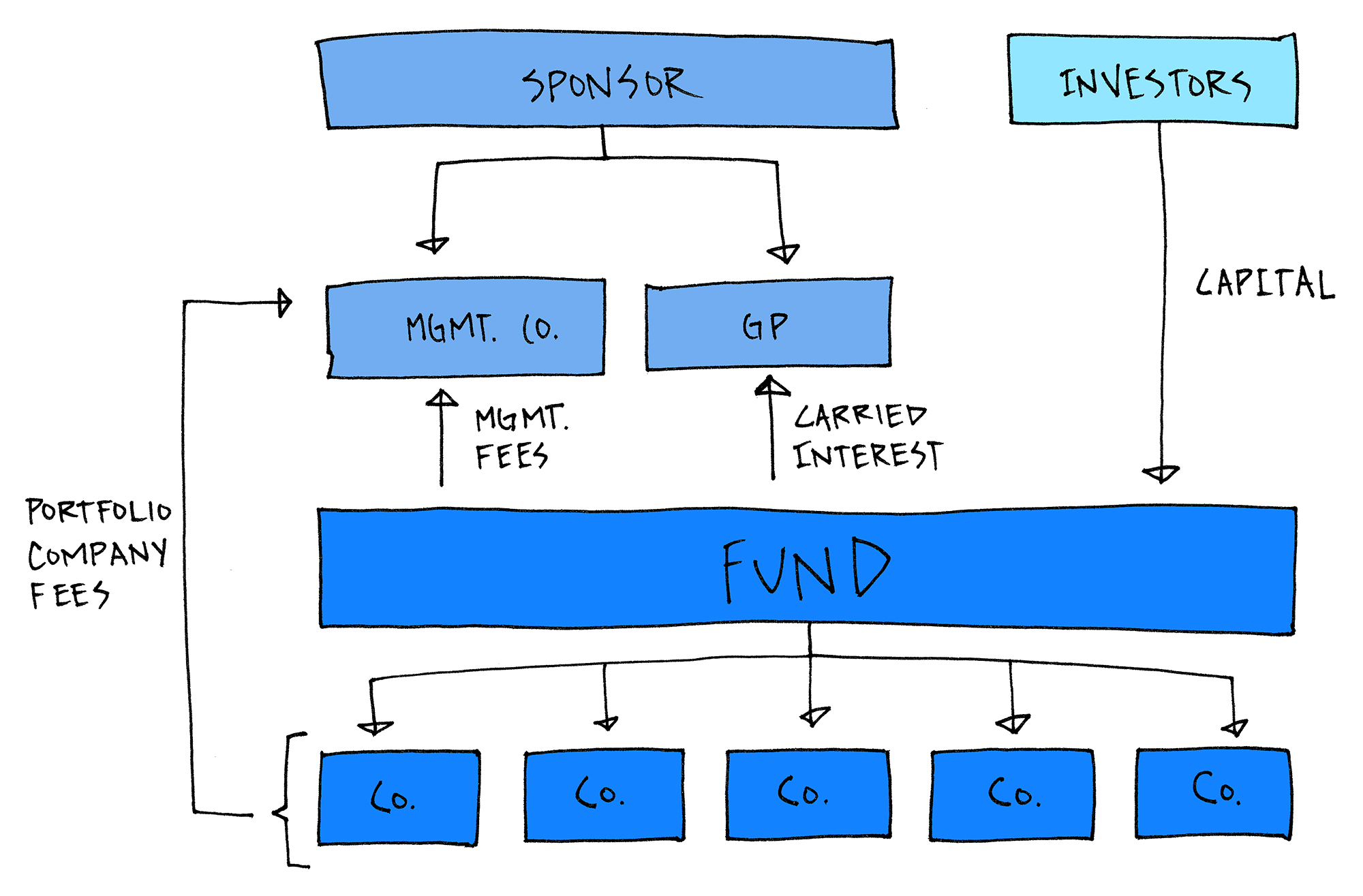

Most private equity deals begin with private equity funds. A private equity fund looks for high-value investors, such as accredited investors and institutional investors. The investors each contribute money to the fund as limited partners.

The limited partners assume a financial risk with the investment, since the investment may not pay off. There is also a time component involved, since returning a company to profitability can take several years.

That’s why you must be an accredited investor before you can start with these kinds of investments. You need enough personal wealth or active income that you can reasonably afford to wait for years before you see any profit from the deal. As a limited partner, you take on a limited amount of liability.

A fund also has general partners. These partners typically handle the actual management of the fund and assume full liability.

How Do Private Equity Investments Work?

As a general rule, private equity funds look to raise a set amount of money. For example, one fund may look to raise $100 million while another might look to raise $1 billion. Once they reach that set amount, the fund will close to future investment.

The individual investment amounts vary from fund to fund. In some cases, the minimum is tens of millions of dollars. On the smaller side, they can go as low as a few hundred thousand dollars.

As with all investments, there is a risk that you won’t see a dime of profit and may lose the entire investment. Always start small and only invest what you can afford to lose.

Once you invest, though, you function primarily as a financial investor. Other people handle the allocation of funds and select the companies for investment. These are typically experienced investors with track records of solid performance.

Assuming the turnaround of the company or companies the fund invests in succeed, the companies are sold off at a profit. You get a piece of those profits based on your contribution.

You can sometimes find opportunities for private equity investment by way of a private equity platform.

Private Equity Vs Venture Capital

If you think this sounds a bit like venture capital investing, you’re completely right. Venture capital is a form of private equity, but it operates in a slightly different way.

Venture capital focuses almost exclusively on new businesses, such as tech startups. The venture capitalists work from the assumption that good funding and good advice can keep the business on track. The end goal in most cases is not to sell the startup to another company, but to take the company public in an initial public offering.

Assuming the company has a good IPO, the venture capital fund can profit by selling off its ownership stake or stock in the business.

Private Equity Vs Mutual Funds

Another common investment option that people explore is mutual funds. You can think of mutual funds as the polar opposite of private equity funds. Where PE funds look for accredited investors with high net worth, mutual funds get their money from average investors. Where PE funds invest in private companies that don’t appear on public stock exchanges, mutual funds invest in public companies.

Mutual funds managers typically do not invest in troubled companies. Instead, they look for companies with a solid track record of profitability and stable growth. Profitability and stable growth in a company typically translate into stable gains for the mutual fund as well.

Getting Started

Before you fix your sights on a particular private equity fund for investment, you should consult with your financial advisor. Get a clear picture of your current and projected net worth and liquidity. Private equity is often a substantial investment, and it’s often very difficult for individual investors to exit the fund.

You must ensure that you can maintain your lifestyle without difficulty for up to five years without access to those funds.

Private Equity Funds and You

Private equity funds can offer you extraordinary returns on your investment, but it’s not a guarantee. The investment minimum is substantial. Even more salient for most investors is that you will have to wait for years before you see any profits from that investment.

Those reasons are why the funds are only open to accredited investors. If you are an accredited investor, though, private equity opens up a different kind of investment option for you.

Looking for more investment information? Check out the posts in our Business section.